Why building trust and loyalty with passive investors is at the crux of real estate investing

December 1, 2022

Disclaimer: I am not a tax professional, and this is not tax advice. Please consult a qualified CPA before making any tax-related decisions.

The US tax code is between 5,000 and 6,000 pages. Some estimates are 10X this number. Tax law is complex, so not every accountant will deliver you the overall tax burden reduction that the law entitles you to. This especially applies to bonus depreciation for real estate professionals. Read below to learn how taking advantage of bonus depreciation can help you save hundreds of thousands of dollars.

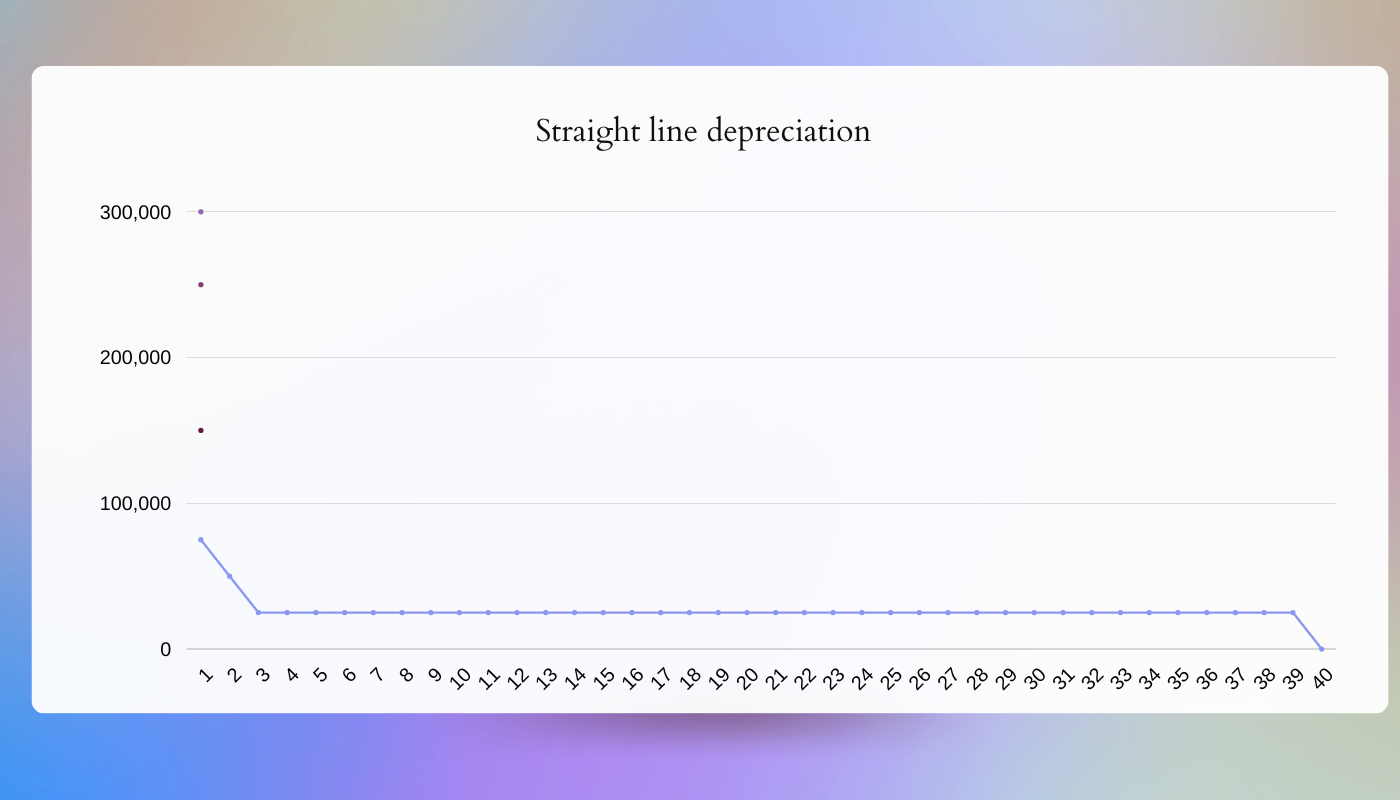

With straight-line depreciation, there is a larger depreciation expense in the first year. Going forward, it drops down to an equal annual amount. Here is the chart to demonstrate that:

The higher amount in the first year is typical for furniture, equipment, and other assets that have a shorter life than the building. After the first year, the rest of the building’s value is spread evenly over the remaining years of life. The name straight line means exactly the line you see on the chart above.

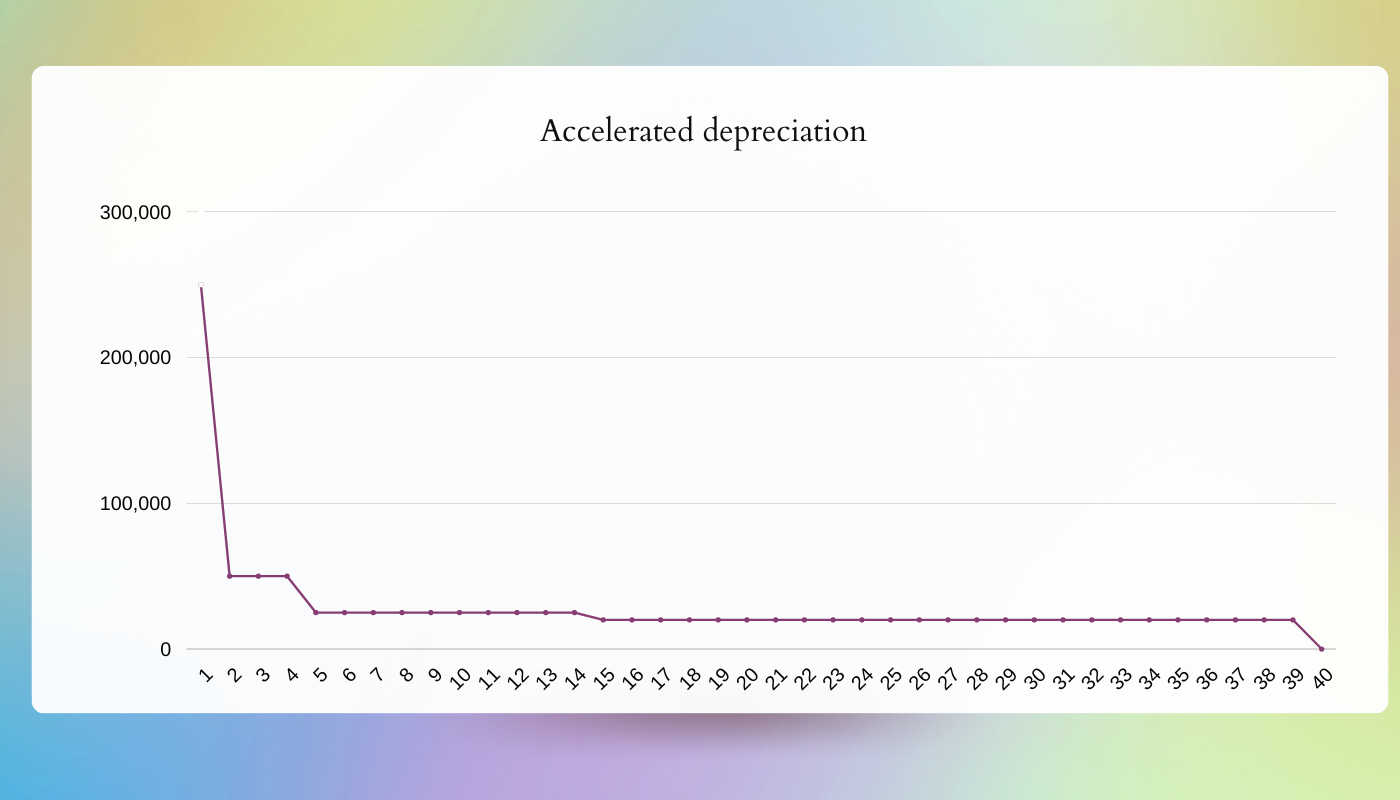

Now, let’s take a look at accelerated or bonus depreciation:

The chart shows how accelerated depreciation moves a large portion of the depreciation amount to earlier in the write-off period. In the example above, it totals $450K. Accelerating or moving depreciation forward, means that your business can take advantage of that write-off sooner, resulting in less reported income. As a result, you pay less taxes and get to keep more money for your business.

Although the two methods are very different in the first years, by year 15, accelerated depreciation settles into a straight pattern as well. Also, the total accumulated amount is the same for both depreciation methods. The crucial difference is when it is recorded for accounting purposes.

You can deduct passive losses from your rentals only against your passive income if you are a passive investor. So the tax benefits are much less than for active investors or RE professionals. However, if you can’t get a Real Estate Professional status, you could consider becoming an active investor if tax benefits are essential for you.

Active investors can deduct up to $25K of those losses against other types of income (including W2 income) if they make adjusted gross income married filing jointly of $150K or less (it doesn’t apply to Limited Partnerships). If this is something you would like to do and bring your income down to $150K, you can max out your 401K contribution.

However, you should still track your expenses even if your income is higher because you will get those losses back when you sell those rentals.

All you have to do to qualify for an active investor status is to make decisions related to your rental property. For example:

Moreover, residential rental property rarely shows a taxable profit on paper when filing taxes, especially if your rental has a mortgage on it. When you add up the deductible expenditures of mortgage interest, property taxes, insurance, and depreciation, those four items nearly always surpass the total rental revenue collected for the year. Then other rental expenses like repairs and maintenance almost guarantee to have a loss every year.

As a result, if you are an active investor, you can use up to $25K of your excess losses against your other income. If you don’t have other sources of income, you can carry the losses exceeding the rental income forward to the following year. So the amount will grow with each passing year. When you sell the property, you can realize those losses in that tax year.

A passive loss is a loss from a business you are invested in that is not a corporation. For example, if you are an angel investor in a small company and invested $50K, your income which flows through on your K1 from that company would be passive and losses too. If you are involved in the decision-making and operations of that company, IRS will qualify your income and losses as active. The same is true for rental real estate.

However, suppose you are a real estate professional. In that case, ALL the losses that come from your rental properties’ operation are immediately deductible from your other income, whether yours or your spouse’s. Moreover, they are no longer considered passive.

To qualify, you or your spouse need to spend more time doing real estate than anything else. The requirement is a minimum of 750 hours in the trade and more than 50% of your time in real estate. It is an average of 14 hours a week spent at your rental properties and less than 14 hours a week in another job or business. If you work in a non-real estate W2 job for more than 14 hours a week, you can’t qualify.

What’s more, you should spend 500 out of 750 hours materially participating in each rental activity. Although the tax code says that the timesheet is not required, it actually is. If you look at the number of cases that qualified for the REP status, they are very few. You need to track your hours and what you do. However, if you are working full-time in real estate, tracking your hours might not be as essential. Nevertheless, we still recommend keeping timesheets as it’s beneficial for your overall business taxes as well.

Other qualifiers include how much income you generate from real estate vs. your W2 job, etc.

Many accountants miss that if you have the real estate professional status, you qualify for aggregation election so that all your rental properties will be treated as one activity (code section 469 C7). You have to file the aggregation election every year. Some accountants miss this point very often, and many people who qualify end up losing out because of it. However, you might want to sell all or some of those properties before getting your REP status and filing the aggregation election because of the net investment income tax.

Here is a handy summary of the key criteria:

It can be challenging to do, but it’s worth it.

Depreciation is the best tax write-off on the planet. It’s the most significant tax benefit of real estate. When you buy a property, you have to divide it into four parts:

For IRS, someday (in 27.5 years), this building will be of no economic value. Just like the laptop that you purchase today will blow up at some point. Therefore, the IRS lets you depreciate this building for over 27,5 years and take 1/27.5 of that per year. If the land value is $20K and the house value is $80K, the total value is $100K. Consequently, if you qualify to benefit from the depreciation tax deduction, you can write off $2,909 yearly for 27.5 years.

The Tax Cuts and Jobs Act of 2017 expanded bonus depreciation, and now used property is eligible for bonus depreciation too. This was a significant change for the real estate industry. Because most real estate (including the contents of the building) is not brand new, historically bonus depreciation did not apply to real estate in most cases.

The key benefit of bonus depreciation is that instead of deducting it over a period of time, like in the example above, you get to deduct the cost immediately the day you place the asset in service. It means that everything that has a class life and depreciates in less than 20 years can be deducted immediately.

When you buy a residential rental property, you should consider what you are buying with it, including:

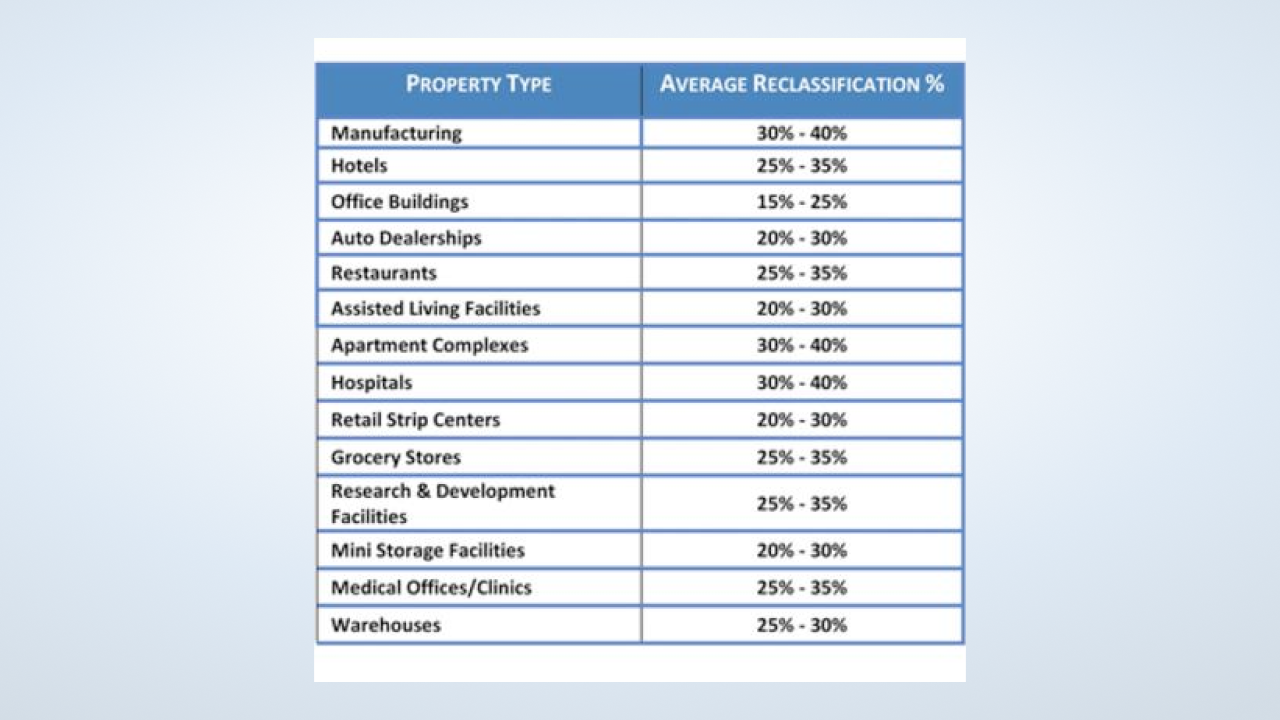

The IRS treats these four components differently. For example, the land never wears out, so you don’t get any deductions on it. Building wears out in 27.5 years, while land improvements, in general, last 10 to 15 years, and the contents of the building (carpets, etc), last for 5 to 7 years. A cost segregation study breaks down what % of your purchase can be allocated to each of these four components and the land improvements and the content of the building, you can deduct 100% in the first year.

For example, 20% of your property is land, 50% of your property is the building, 20% is the building contents and 10% is the land improvements. As a result, you can deduct up to 30% of the price in the first year using bonus depreciation.

For real estate professionals, there is NO CAP to your deductions in year one. Even if your depreciation is so big that it offsets ALL of your income and creates a loss, you can carry this loss forward to future years. While for passive and active investors, it is capped.

Image sourceFor many real estate professionals, bonus depreciation becomes addictive (in a good sense). As a result, they keep buying more real estate every year. The more real estate they buy, the fewer taxes they pay.

One of the main objections is that it’s expensive and look at it as an expense instead of looking at it as an investment. A professional cost segregation study costs approximately $20K. However, considering that you can deduct up to $3M on a $10M property – it’s a great return on investment.

For passive investors who are not real estate professionals: You can use this $400K taxable passive loss to offset your other passive income (from other rental properties or passive investments, like in real estate syndication deals) or gain from the sale of your passive activity (whether a property or company shares, where you were a passive investor).

For real estate professionals: The net taxable loss of $400K will not be passive, and you can then utilize it to offset your other income, whether your W2, earnings from your own business, etc.

There’s no denying that you can make money investing in real estate, but the question is how much. One way to significantly boost your income is by getting a real estate professional status. In many cases, it will be the best decision you ever make, especially if you are trying to hedge your W2 income. It will require some extra effort, but it sure beats working 9 to 5, right?

The legal work necessary to become a real estate professional is complex, and you can’t take on this risk without an experienced accountant.