The ultimate guide to real estate investment software

September 29, 2023

This article will talk about the last and probably the most crucial step of the multifamily acquisition process – making an offer for your multifamily deal.

Now you’ve spent time setting your SMART goals, defining your criteria, looking for deals, evaluating the property, building your syndication team, studying the local area and the market, and taking care of due diligence. It’s time to make an offer.

Before making an offer, take a final look at your criteria and ensure that the property meets them, meaning that the price, the size, the location, the class, the level of rehab, physical assets, the business model, and the financing for this property are in line with what you’ve defined earlier. The deal either matches your criteria or doesn’t. If it doesn’t, you should pass on it and continue looking for something that suits you. What’s not a good deal for you might be a good deal for another syndicator.

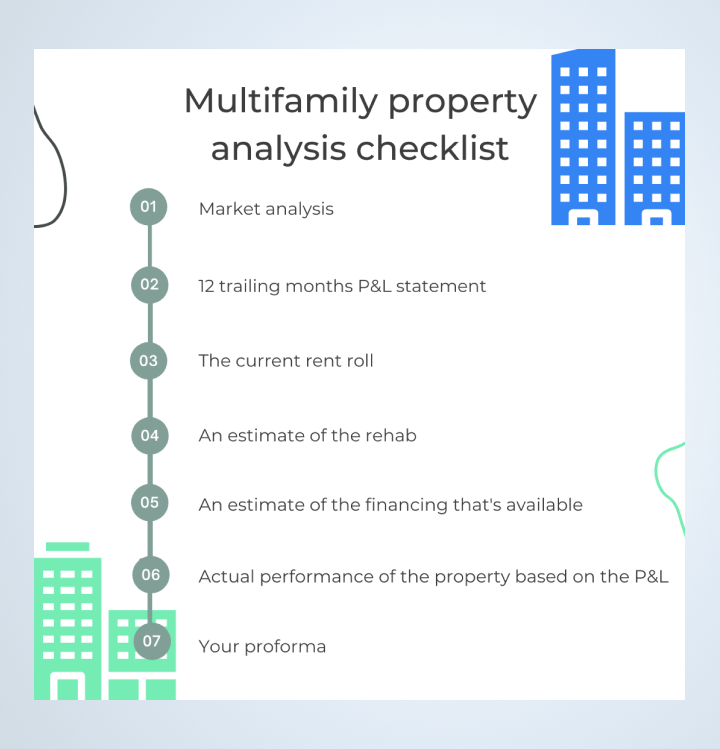

Once you confirmed that the property is right for you, you can run the property analysis before your site visit and indeed before sending the offer. The property analysis should include:

Once this is done and you’ve also completed the site visit with the owner or the broker, looked at the amenities, units, office, etc., you can fine-tune your rehab estimate and identify opportunities and challenges. Now, there are some final steps to take before making the offer. They include:

The LOI’s objective is to agree on the price and critical T&C before submitting a contract. Remember that real estate contracts take time as they can be as long as 20 pages. Therefore, before spending time on creating the contract and paying an attorney, you have an opportunity to submit your LOI with critical terms and pricing. If you can agree on the critical points of the LOI, you will be able to agree on the contract.

Below are the five main points you need to include in your LOI. Remember that most of these terms are negotiable, so always leave a small room for negotiation.

If you’ve done property analysis, you will develop the price that works for you; however, leave some room to go up. Even if your initial offer matches the seller’s expectations, they will still ask for more.

Don’t start your negotiations at the maximum price you are willing to pay. Offer 5-10% below the number that works for you. Anything below that can damage your reputation. Typically deals sell for greater than 90% of the asking price, and some deals in hot markets sell at 100% of the asking price or even above the asking price. If you have good relationships with the broker, they will help guide you on the price.

The amount of the earnest money you will deposit with the title company. The rule of thumb for earnest money is 1% or more of your purchase price. Another important term is whether this money is refundable or non-refundable (“hard” earnest money). Typically, earnest money can become non-refundable after the following milestones.

The rule of thumb for the due diligence period is 21 calendar days. Whether you are doing due diligence on a large 300-unit property or a smaller 100-units, 21 days is enough provided that you have your real estate syndication team, particularly the contractors, lined up and involved in the process.

Weather is also essential. For example, if it is raining for two weeks in a row and contractors can’t get up on the roof or during a holiday period, try to push for more extended due diligence. Remember that you will need to have all your contractors on the property, checking the sewage, walking the units, checking the electricity, roof, plumbing, etc. Then it will take a few days for them to send you the reports.

In the meantime, you will be shopping your comps, doing market analysis, and reviewing seller documents (service agreements, property management agreements, landscaper, laundry provider, utility provider agreements, etc.).

The purpose of due diligence is to provide you with a contingency period when you can conduct market analysis, units walks, physical inspections, review seller docs, and title commitment with your attorney. All your contingencies for these items are waived at the end of the due diligence period (at the conclusion). However, if your earnest money is non-refundable from Day 1, you don’t really have a contingency period for your due diligence.

Sellers want your due diligence to be quick because buyers often back out of a deal during the due diligence period. Therefore, once you complete your due diligence, the seller is more confident that you will proceed with the property purchase. You should talk to the broker first to determine the expectations because sometimes, having a shorter due diligence period is essential if you want your offer to win. Sometimes this period is less important for the seller. Hence, finding this out is critical for the success of your LOI.

One of the critical terms is financing contingency which allows you to get your earnest money back if you don’t get the loan. In the buyers market, a financing contingency gives you a certain number of days to get your loan approved.

If you fail to get the loan approved, you can back out of the deal and get your earnest money back. However, if it’s a hot deal or a seller’s market, you might need to waive your financing contingency depending on your discussion with the broker.

Financing contingency contains:

Suppose any of the above terms change after your financing contingency period. In this case, the buyer has the right to back out of the deal and get the earnest money refunded.

Remember that the seller would want this period to be as short as possible. You, as a buyer, need to determine a realistic period. This, however, doesn’t mean that the buyer needs a long period because once the deal is on the market and you have it under contract, the seller has to provide their staff with a stay-on bonus or a performance bonus. When the staff finds out that the property is for sale, they usually start looking for jobs and leaving. As a result, it is not in the buyer’s interest to have an extended closing period.

The main bottleneck in the closing is the lending process. Your multifamily mortgage broker will guide you through the timelines.

Typically this period can take from 40 to 70 days and consists of:

Once you’ve discussed and finalized these terms with your syndication team, call the broker before sending the offer. Get the broker’s feedback on how the seller will receive this letter.

In addition to your LOI, you can prepare the following to look more professional in front of the broker and the seller and increase your chances of getting the deal.

In this article, we described the LOI process on a high level. Many materials on the internet, including the LOI templates, YouTube videos, and blogs for syndicators, will help you dive more in-depth and get 100% prepared before sending out your first offer.

Remember, real estate syndication is a relationship business. Therefore, you have to focus on building rapport with your broker before sending the LOI so that they can guide you on the terms and save you time, money, and reputation.