Why building trust and loyalty with passive investors is at the crux of real estate investing

December 1, 2022

Real estate promote is usually shown as an equity waterfall, one of the most daunting real estate syndication concepts. When you are just starting out in the world of real estate private equity, one of the most confusing aspects is usually understanding equity waterfalls. Many people scour the net for days trying to get their heads around this concept, but it just seems so complicated and confusing that many give up on it. To confuse things even further, there are multiple kinds of equity waterfall structures that you need to know about.

This article will break down the sponsor promote concept step-by-step in a simplified, easy-to-understand manner. Click on one of the links below to navigate through the article.

Before we continue, we would like to note that you should separate sponsor promote from other fees that a general partner in a real estate syndication might earn, including asset management fees, acquisition fees, and disposition fees.

To explain what equity waterfall is, we will use an example. Let’s say you are in the process of building your multifamily portfolio and decided to buy an apartment complex. You have $100,000 to invest, and you start looking for your first deal. After many months of searching, evaluating, and vetting deals, you finally found a deal that 100% matches your goals.

At the asking price of this deal, you believe that you can hit 15% of the Internal Rate of Return (IRR) over a five-year hold period. The challenge is that this deal is listed at $3.3M, meaning that even if you get 70% of the purchase price as loan proceeds, you still need to raise $900K to close on this deal. Even though you only have $100K to invest, you strongly believe in this deal’s potential and want to close it.

However, since you don’t have $900K, you need to look for one or more equity partners to fund your deal and start the equity-raising process. Since you are raising capital from investors, you’ve created a real estate syndication. You start speaking to people among your friends and family who might have the funds to invest in your deal, and you found 18 equity investors ready to invest $50K each.

You tell your investors that you will do all the work, from closing to asset managing and operating the property. They agree to invest $50K each if you invest your $100K to have some skin in the game.

Now, we have $2.3M of debt and $1M of equity ($900K is raised from your limited partners, and $100K is yours). This equity breakdown is a typical structure in real estate syndication. The deal sponsor funds 1%-10% of the total equity and does all the work on the deal, and limited partners or passive investors fund 99%-90% of the equity and are not involved in the deal management process. Consequently, you end up controlling $3.3M of real estate with only $100K of your own capital.

There are many waterfall calculators and excel models that you could use. However, the easiest way is to have real estate syndication software that will do automatic calculations for you, like Cash Flow Portal:

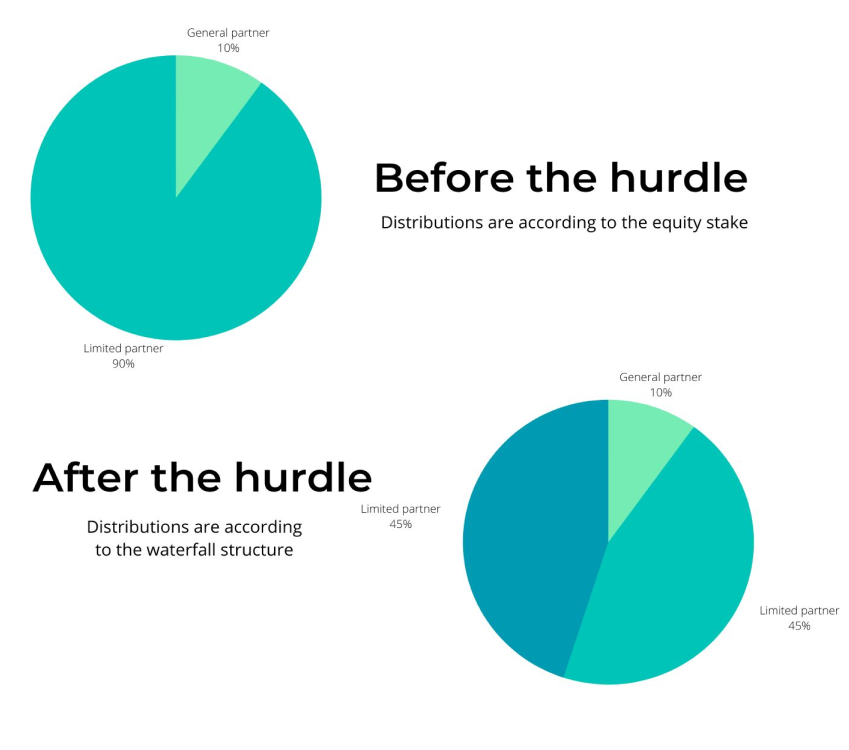

Next, you agree with your investors that, till you hit 8% IRR, you will split portions proportionally to the investment. So, because you invested $100K out of $1M, you will get 10% of all the cash flows, and your investors will get 90%.

However, since you will be doing all the work (we call it sweat equity), you tell your investors that you need an additional reward for your efforts to achieve significant returns for them once your investment reaches 8% IRR. Consequently, for every $1 of profit over 8% IRR, you will take 25% of what his profits would otherwise be. This 25% is called sponsor promote.

This story shows how the equity waterfall is formed. You ask for 25% of passive investor profits over 8% IRR, and it is NOT 25% of all profits. It’s 25% of the 90% that you are getting to split your total cash flow as a general partner. It means that for every $1 of profit over 8% IRR, you are going to take 25% of your LP’s profit or 25% * 90% = 22.5% of the total profit. Plus your initial 10% of the profit. 25% + 10% = 35% of total profit for every $1 of profit over 8% IRR.

Another term for “sponsor promote” is carried interest. It is an incentive plan that further enhances the alignment of interests between general and limited partners. Additional to investing own capital into the real estate deal, the sponsor takes on a heavy-lifting role to boost returns for passive investors and gets compensated for this by sponsor promote.

Sponsor promote is the amount of profit that a sponsor receives above what he would typically earn according to his contributed capital to the deal (after the hurdle). It also has tiers.

For example, above 8% IRR, the sponsor earns 25.6% of all the excess profits above his pro-rata share. Above 8% IRR and up to 15% IRR, since John contributed 93.4% of total equity, he receives 80% of 93.4% or 74.4%. The sponsor gets the balance of 25.6% of the excess profit above his pro-rata contribution of 6.6%.

This split continues till the deal reaches 15% IRR. Once this threshold is hit, any remaining net profit is distributed 60% to LPs and 40% to GPs as promoted interest.

What does it mean?

It means that the investor receives 60% of 93.4% or 56% of profits above a 15% IRR and the GP gets 44% of excess profits, including his 6% contribution.

To earn a promote or carried interest, the sponsor does the following crucial activities, necessary to ensure that investors receive profits:

The deal sponsor does all of the heavy lifting and has his sweat equity in the deal. At the same time, investors have purely passive income and rely on the GP to execute all the items we listed above. Therefore, the sponsor promote motivates general partners to exceed initial goals and go beyond the original business plan. If the GP exceeds expectations, he earns a bonus in the form of promote.

The promote structure can vary from deal to deal, depending on the property type and GP. Usually, the more work the sponsor has to do to achieve targeted IRR, the bigger piece of the pie he receives.

A waterfall structure aims at rewarding deal sponsors for exceeding investor expectations in a specific deal or for exceeding investors’ potential achievements with another investment vehicle with similar risk.

Therefore, return hurdles and their calculations can vary from deal to deal and if you are a general partner doing your first deal it can feel quite overwhelming when it comes to picking the right waterfall structure. So here are some ways to choose the best waterfall structure for your deal. The rule of thumb is to create a win-win scenario and keep return hurdles high enough so that when they are hit, passive investors are satisfied.

Today, real estate investors that are looking to passively invest in syndications, have access to more information than ever in the history of commercial real estate. Crowdfunding platforms, networking events, and mastermind groups are perfect places for passive investors to learn about market rates for each specific market. If your investors discover less costly similar investment options, they might never invest with you again. Investor trust is an asset that can’t be undervalued.

When a deal sponsor can’t defend the waterfall structure he is proposing, he needs to keep adjusting it till he can confidently back it up. If you are doing deals similar to other syndicators in your market, your fee structure must be competitive and transparent.

If you as a general partner work with smaller deals and non-institutional capital – pick a structure that is simple. The more complex your structure is – the more you risk losing your potential limited partners and will have a harder time raising capital. The same applies if you are a non-institutional passive investor investing in a smaller multifamily deal. Avoid over-complicated waterfall structures. So if you don’t understand something in your investment structure – simply don’t invest.

However, if you, as a general partner, get involved in transactions with sophisticated institutional capital partners, you might want to add some complexity to the waterfall structure.

If you and your limited partners are investing in a real estate deal to generate cash flow with an indefinite hold period, the general partner needs to have a cash-on-cash bases structure, to get an incentive for holding the property long-term and increasing cash flow and investor cash flow distributions on a long-term basis.

Suppose you and your investors’ goal is to recycle capital quickly by generating short-term profit. In this case, the sponsor gets incentivized by the IRR-based structure to add maximum value to the asset, sell the property, and generate a profit in a short period of time.

Another structure is when investors are after wealth preservation and long-term appreciation, which is common for investors building generational wealth. Here equity-multiple structure motivates deal sponsors to generate cash flow for many years and to postpone the sale till a significant gain can be made. Usually, the hold period in such deals is 7 to 10 years or longer.

You can mix and match these structures. It means that you can have a waterfall structure with both equity multiple and IRR hurdles. Or, depending on your goals, you could combine a cash-on-cash hurdle with a separate cash flow split upon sale. It’s essential to remember that whatever combination you go for, it has to align with the original intent of the investment.

Promote structures have an incentive nature. Its goal is to align the interests of the general partner with those of the equity investors. Each of the parties involved needs to monitor misalignment, especially if investors want to control some key matters.

The asset is still the most crucial element, so when reviewing the promote structure, keep things in perspective. If the commercial property is an excellent one, was purchased at a competitive price, and performs well – a generous sponsor promote to the general partner is a fantastic way to continue reaping even more benefits out of this asset.

The sponsor’s right to promote participation is defined in operating agreements. Most of them state that if the sponsor engages in improper conduct or defaults on the obligation, the sponsor loses the right to sponsor’s promote. If this happens, most LLC agreements empower the investors to remove the sponsor. As a result, the sponsor becomes an LP or a passive investor to the extent of his actual capital contribution to this deal. Then investors select another managing partner and he becomes entitled to the promote.